The DPS Ordinance has provided that, if there is a bank merger or acquisition involving a transfer of protected deposits among two or more Scheme members, and you have pre-existing protected deposits with two or more of the relevant Scheme members immediately before the date of merger or acquisition, then you will have an additional coverage for your protected deposits transferred from each of the original Scheme member(s) up to the standard protection limit, on top of the standard protection limit available at the resulting Scheme member. Such enhanced deposit protection will last for six months generally (longer if a time deposit is involved and its original maturity date falls after the expiry of the six-month period). The maximum amount of protection will revert to the standard protection limit after the expiry of the enhanced protection period.

1

Please refer to the

Part I of the Frequently Asked Questions for more information about the enhanced deposit protection in the event of a merger or acquisition involving Scheme members.

Determination of compensation if the resulting Scheme member failed after a merger or acquisition

The following examples show how compensation under the Scheme is calculated for persons having protected deposits with relevant Scheme members immediately before a merger or acquisition.

Example 1:

Depositors having savings deposits with two or more relevant Scheme members immediately before a merger or acquisition

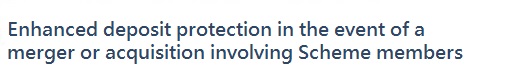

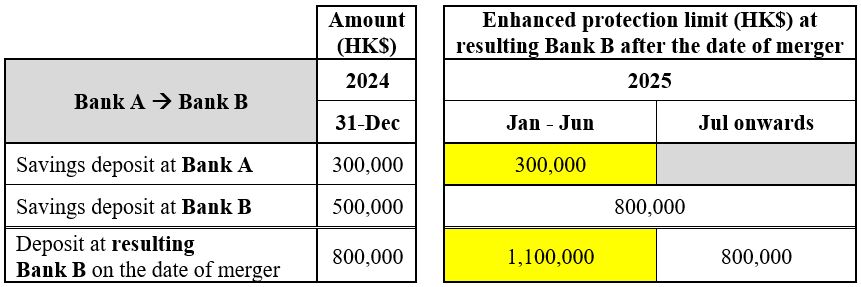

Assume Bank A merges with Bank B and all deposits are transferred from Bank A to Bank B on 1 January 2025 (i.e. effective date of merger).

(a) If a depositor had HK$300,000 at Bank A and HK$500,000 at Bank B immediately before the effective date of merger, the depositor will be entitled to a maximum compensation of HK$1.1 million (i.e. HK$300,000 + HK$800,000) at the resulting Bank B during the six-month period.

(b) If another depositor had HK$900,000 at Bank A and HK$800,000 at Bank B immediately before the effective date of merger, the depositor will be entitled to a maximum compensation of HK$1.6 million (i.e. HK$800,000 + HK$800,000) at the resulting Bank B during the six-month period.

Example 2:

Depositors having both savings and time deposits with two or more relevant Scheme members immediately before a merger or acquisition

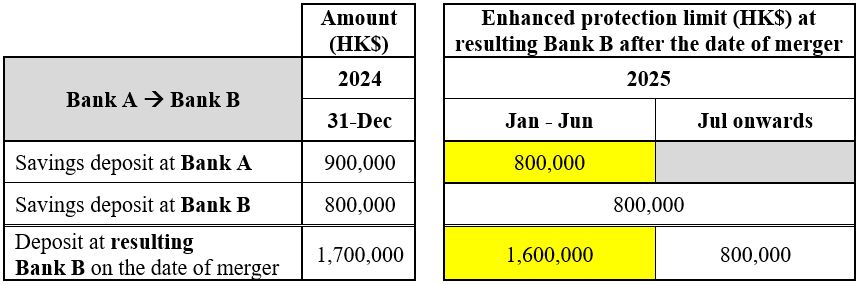

Assume Bank A merges with Bank B and all deposits are transferred from Bank A to Bank B on 1 January 2025 (i.e. effective date of merger).

If a depositor had a deposit portfolio at Bank A immediately before the effective date of merger, containing a savings deposit and two time deposits with original maturity dates beyond six months after the effective date of merger, the enhanced deposit protection period will be extended.

During the six-month period (i.e. January to June 2025), the enhanced deposit protection limit will be HK$1.6 million as the depositor will have an additional coverage for all his / her protected deposits transferred from Bank A to Bank B (up to the standard protection limit) plus the standard protection limit originally available at Bank B (i.e. HK$800,000 + HK$800,000).

After the expiry of the six-month period, the additional coverage will only be available to those transferred time deposits with original maturity dates beyond the six-month period. Therefore, from July to September 2025, the deposit protection limit will be HK$1.5 million (i.e. HK$700,000 + HK$800,000). During October 2025, the deposit protection limit will be reduced to HK$1.2 million (i.e. HK$400,000 + HK$800,000). From November 2025 onwards, the protection available for the depositor at the resulting Bank B will revert to the standard protection limit.

1 Separately, pursuant to the Financial Institutions (Resolution) Ordinance, in the event of a transfer of protected deposits from a failing Scheme member (transferor) to a viable existing one (transferee) as part of the exercise of resolution transfer powers, and you have pre-existing protected deposits with the transferor immediately before the transfer date that have been included in the transfer, you will have an additional coverage for your protected deposits transferred from the transferor, up to the standard protection limit for a limited period of time, in addition to the standard protection limit available at the transferee, even if you were not a depositor of the transferee before. The maximum amount of protection will revert to the standard protection limit after the expiry of the enhanced protection period.